Recapitulative Statement

Offers solutions related to the filing of recapitulative statements (also known as EC Sales Lists) for businesses engaged in cross-border transactions within the European Union (EU).

Automated Data Collection

Collects the relevant transactional data from the accounting software, which are necessary for generating Recapitulative Statements. This includes sales of goods and services to VAT-registered customers in other EU member states.

Compliance Updates

The platform provides automatic updates regarding changes in EU VAT regulations impacting Recapitulative Statements. It can also issue alerts and reminders to users regarding upcoming filing deadlines, potential compliance issues, or data discrepancies that require attention.

Statement Generation

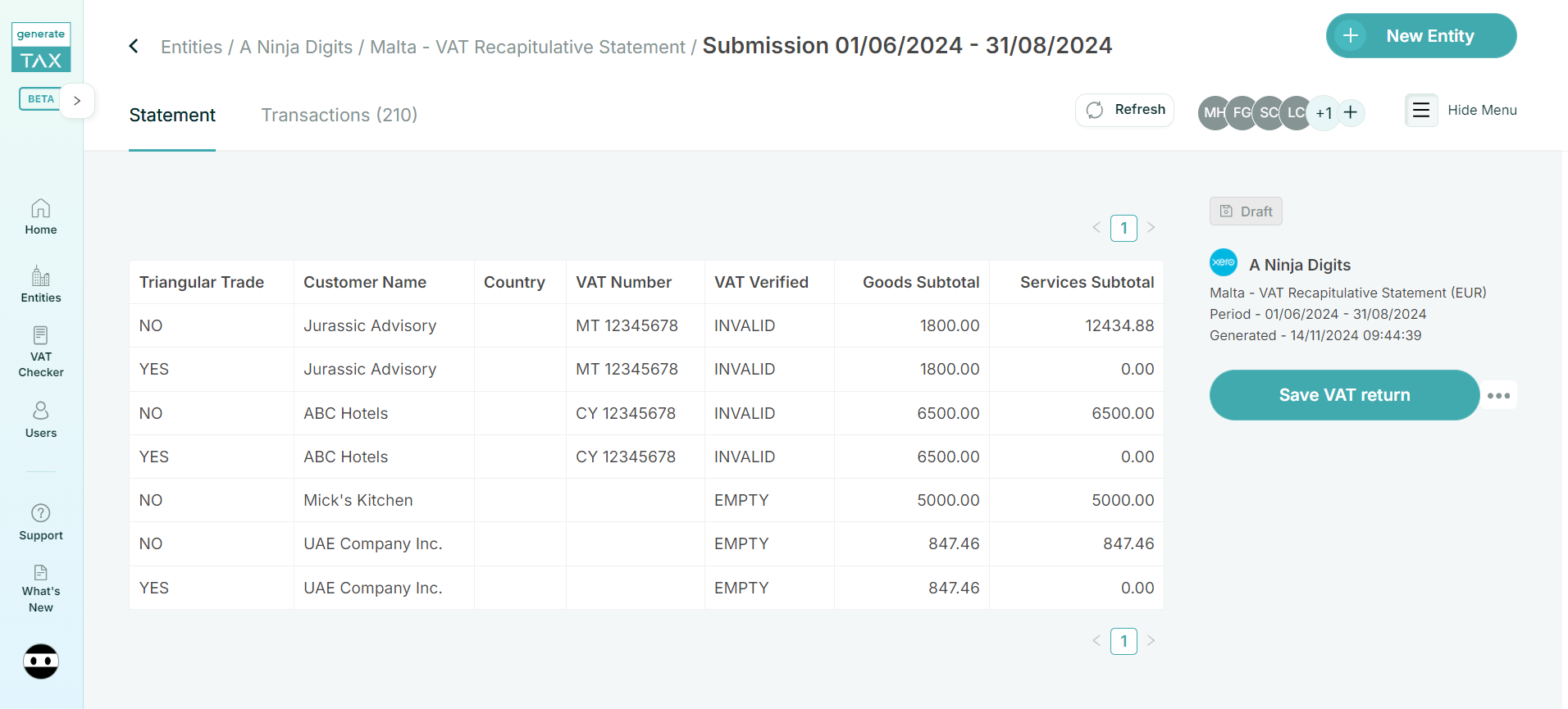

Creates the Recapitulative Statements in the required format as specified by EU VAT regulations. This includes structuring the report with the necessary fields such as VATINs of customers, transaction values, VAT rates, and totals for each EU member state where transactions have occurred. The statement generation feature facilitates the process of submission of the recapitulative statements to the tax authority portals.

Flexibility

Recapitulative Statements can be tailored based on specific business needs or reporting preferences. This could include selecting reporting periods (e.g., monthly, quarterly), adjusting currency conversions (if applicable), and including additional data for detailed analysis or compliance purposes.

Reporting & Audit Trails

Provides the ability to generate a report for recapitulative statements, which includes detailed summaries, transaction breakdown by EU member states including the validation of VAT numbers of customers and suppliers through the VAT checker. An audit trail is kept as soon as a statement is saved to keep track of any changes made to the declaration.

How it works

Financial Highlights at a Glance

Clear insights on your finances

With the recap statement feature, you can generate a periodical statement required to view intra-Community supplies of goods to customers identified with a valid VAT Registration number in another Member State.

Review Every Transaction

Detailed visibility into your business activity.

Effortlessly dive into each transaction. The transactions feature lets you review the entries comprising your recap statement, complete with live links to your accounting software for seamless access and verification. generate.TAX delivers a comprehensive overview of all financial movements, enabling you to maintain a transparent audit trail for your business.

FAQs

Why is a recapitulative statement important?

A recapitulative statement is a report required by EU VAT regulations, summarizing sales of goods and services to VAT-registered customers in other EU member states. It’s essential for compliance, ensuring proper reporting of intra-EU transactions and helping businesses avoid penalties or fines.

How does generate.TAX collect data for recapitulative statements?

The platform automatically collects the necessary transactional data from your accounting software, including sales to VAT-registered customers in other EU member states. This ensures accurate and timely collection of all required information for generating recapitulative statements.

How does the recapitulative statement feature work?

Recapitulative statements are generated in the required format, as per EU VAT regulations, including necessary fields like VATINs of customers, transaction values, VAT rates, and totals for each EU member state where transactions occurred, ensuring compliance with tax authorities.

Can I tailor the recapitulative statements for my business needs?

Yes, the platform offers flexibility in customizing recapitulative statements. You can adjust reporting periods (e.g., monthly, quarterly), manage currency conversions, and include additional data as needed for detailed analysis or specific compliance requirements.

How does the platform ensure compliance with filing requirements?

The platform ensures compliance by structuring recapitulative statements according to EU VAT regulations and providing reminders about filing deadlines and any potential discrepancies in the data. Automatic updates keep you informed of any regulatory changes that may affect your filings.

Try it for free

Unlock all generate.TAX features for 30 days to help you with the generation of VAT returns

- Connects to Xero

- Safe and secure

- Cancel any time