VAT Number Checker

A powerful solution for ensuring the accuracy and validity of customer and supplier VAT numbers stored within your accounting software. This feature goes beyond simple validation by providing a certification process that verifies the live status of VAT numbers.

Real-time Validation

Users are promptly notified whenever a VAT number stored in their system is no longer considered valid by the VIES database. This real-time notification ensures that businesses can take immediate action, such as updating customer or supplier records, to maintain compliance and prevent potential issues in invoicing and financial reporting.

Software Integration

By combining certification with real-time notifications, generate.TAX empowers businesses to uphold high standards of compliance, transparency, and data integrity in their financial operations.

Compliance

This feature proactively helps businesses stay ahead of compliance requirements and reduces the risk of using outdated or incorrect VAT information. It also strengthens overall VAT compliance measures, contributing to smoother and more reliable intra-EU transactions for businesses of all sizes.

How it works

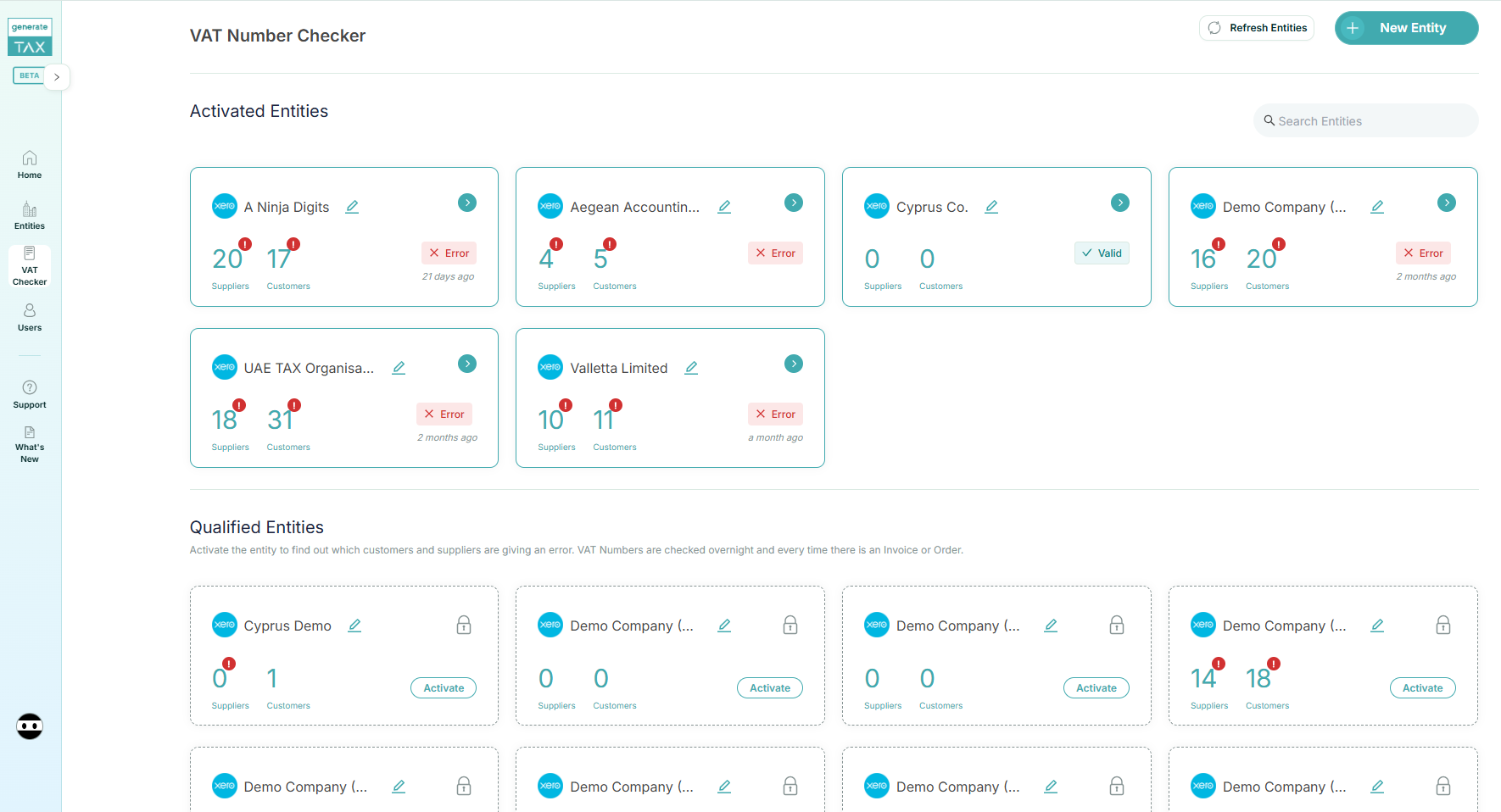

Your Entities in One Place

Stay organised with proactive insights

The VAT number checker organises all your entities into a single, streamlined view, showing the total number of suppliers and customers for each entity.

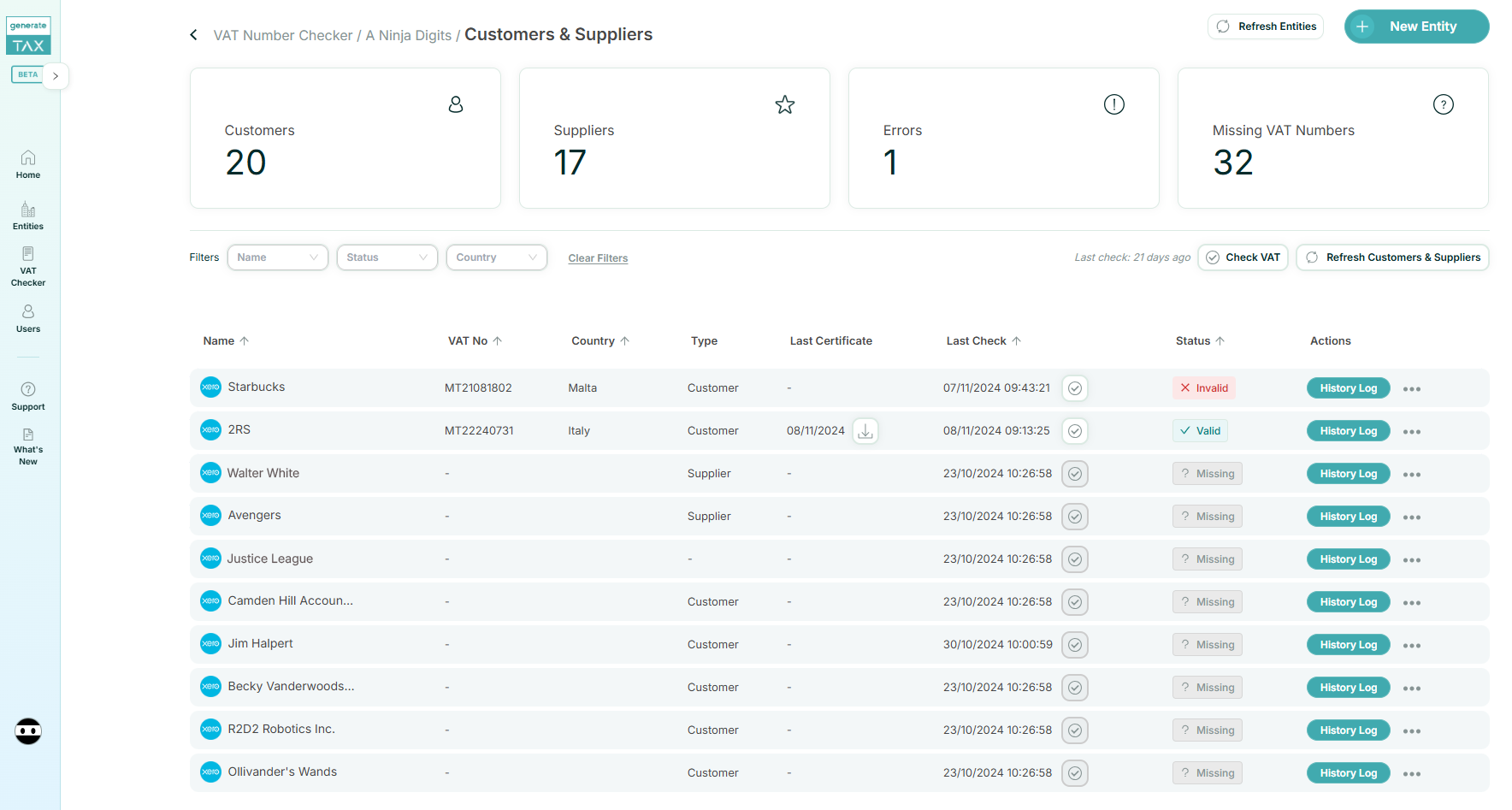

Validation

Ensure accuracy and compliance

generate.TAX automatically checks the validity of VAT numbers entered, reducing the risk of errors and ensuring that all your transactions are properly documented for tax purposes. Quickly identify which VAT numbers are valid, invalid or are missing, helping you maintain compliance and avoid errors.

FAQs

How does the VAT number checker validate VAT numbers?

The VAT number checker validates VAT numbers in real-time by cross-referencing them with the VIES (VAT Information Exchange System) database. If a VAT number is found to be invalid or outdated, users are immediately notified.

Will this feature help with intra-EU transactions?

Yes, the VAT number checker strengthens VAT compliance, particularly for intra-EU transactions, by ensuring the validity of VAT numbers for cross-border business dealings. This helps avoid issues with VAT exemptions and ensures smoother, more reliable transactions.

What happens if a VAT number becomes invalid?

If a VAT number stored in your system is no longer valid according to the VIES database, you will receive an instant notification. This allows you to quickly update your customer or supplier records to avoid potential issues with invoicing and financial reporting.

Does the VAT number checker support all EU countries?

Yes, the VAT number checker works with the VIES database, which covers all EU member states. It allows you to validate VAT numbers for businesses across the European Union, ensuring your transactions are compliant with intra-EU VAT rules.

Can I use the VAT number checker for both customers and suppliers?

Yes, the VAT number checker can be used to validate VAT numbers for both customers and suppliers. This ensures that all parties involved in your transactions are compliant, helping to prevent issues with invoicing, payments, and VAT reporting.

How often are VAT numbers checked?

Every 24 hours it does a run of all the contacts but you can also push a manual check.

Try it for free

Unlock all generate.TAX features for 30 days to help you with the generation of VAT returns

- Connects to Xero

- Safe and secure

- Cancel any time