Designed

for Businesses

Tailored features enable businesses to efficiently manage VAT deadlines and settlement of any VAT liability, reducing misstatements and strengthening financial control and compliance.

International Compliance

generate.TAX ensures compliance with VAT regulations in Malta, Cyprus, Ireland, UAE, Isle of Man, Sweden and the Netherlands. We are actively developing our offerings to comply with different rules and laws in other various territories.

EMEA Tax Software

One software, multiple territories. generate.TAX will help you file VAT returns and other VAT declarations and statements in multiple countries across EMEA and beyond.

Currency Conversion

The system has in-built foreign currency conversion capabilities based on ECB rates to allow users with the ability to translate transactional data into a different currency and thus allowing for the preparation of VAT returns in a currency other than the accounting presentation currency.

How generate.TAX can help you

VAT Regulations Compliance

generate.TAX offers businesses reliable and efficient tools to manage its VAT compliance obligations, ensuring that companies remain compliant with all regulations.

Cost & Time Savings

The automation of VAT reporting and calculations boosts productivity and accuracy, giving users more time to focus on adding value. Its seamless integration empowers organisations to focus more on growth, rather than routine administrative tasks.

Accurate Data

Digitised processes allow for thorough data checking and detection of errors, ensuring precision in reporting and compliance with all regulations. generate.TAX supports the integration of any updated VAT legislation, which leads to improved accuracy, reduced risks of non-compliance, and greater efficiency in managing VAT reporting.

Integration

Seamless integration with your accounting or ERP systems, ensuring smooth data transfer and encourages consistency.

Exception & Reconciliation

Recognises any exceptions for each VAT period, which allows you to keep track of any invoices issued in a prior period but posted in the current period. generate.TAX performs a reconciliation of the VAT balance with your accounting software, ensuring that no differences arise with your accounting records.

Audit Trail

generate.TAX provides you with a complete audit trail of the entire process, from creation to approval to submission with the Authorities, which helps confirm that all processes and submissions are working in line with requirements.

Solutions

Recapitulative Statement

Create a validated list of intra-community suppliers to be submitted to authorities.

FAQs

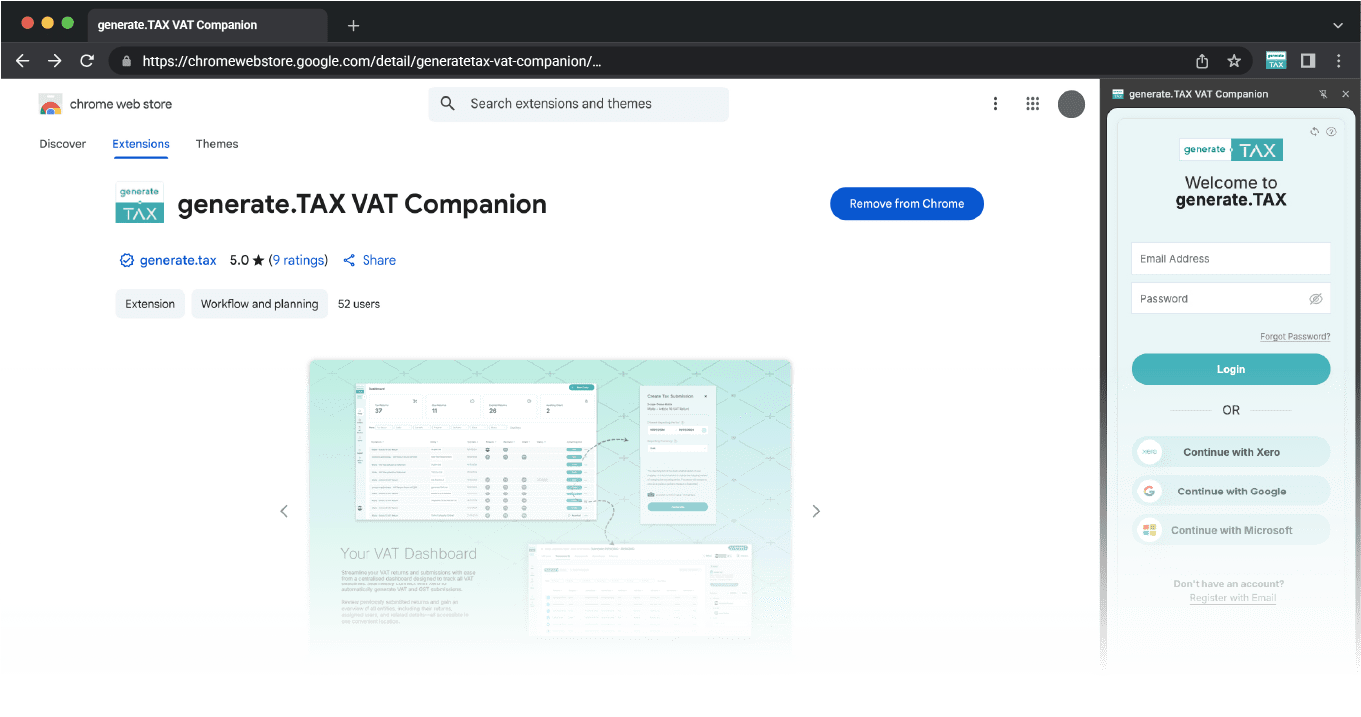

What is generate.TAX?

generate.TAX is a web application that connects to a number of cloud based accounting software to automate the VAT Compliance process. generate.TAX offers users a number of features, including:

- Automatic VAT return preparation: No more manual calculations, the app does it for you.

- Workflow management: Keep your VAT tasks organised and on track.

VAT filing deadline reminders: Never miss a deadline again with timely alerts. - VAT number checks: Verify VAT numbers quickly and easily.

- Reconciliation and issue fixing: Spot and resolve discrepancies without a sweat.

- Audit trails and note-keeping: Maintain clear records for easy reference.

- Direct filing: If the tax authority has an API, you can file right from the app.

generate.TAX works by pulling data from your accounting software, identifying the VAT-related info, and presenting it just like your local VAT return form. It’s VAT compliance made simple!

Is generate.TAX compliant with local VAT regulations?

Yes, generate.TAX is compliant with the local VAT regulations which are kept up-to-date with any changes.

Can generate.TAX handle VAT returns for multiple countries?

generate.TAX supports multiple countries located across EMEA, including Malta, Cyprus, UAE, Ireland, Isle of Man, Sweden and Netherlands. The team is constantly working on introducing more jurisdictions.

What types of returns can be submitted using generate.TAX?

generate.TAX allows the user to submit all VAT filings of each supported territory, including VAT returns, sales listings (recapitulative statements), and any other returns or declarations applicable to the supported territories.

What are the key features of generate.TAX?

generate.TAX offers the users a number of benefits, including but not limited to the following:

- Verification of Customer and Supplier VAT numbers through the VIES checker;

- 2 factor authentication for security purposes;

- Generation of VAT reports with the click of a button;

- Analysing transactions through the app with a click-through functionality that would take the user directly to the accounting software should any adjustment need to be made;

- Detailed workflow and audit trail showing the preparer, reviewer and client approval;

- Capturing any exceptions noted in the VAT returns, including any invoice relating to prior period which was posted after VAT return was submitted.

How easy is it to integrate generate.TAX with existing systems?

generate.TAX is designed to integrate seamlessly with cloud based accounting and ERP systems, making it easy to incorporate into your existing systems. Currently the app integrates with XERO and Quickbooks and will be extended to integrate with other similar accounting software.

How can generate.TAX help in managing workflow for VAT compliance tasks?

generate.TAX allows you to manage the workflow of the VAT compliance tasks through setting up of the preparer, reviewer and client approver, which will ensure that the VAT reports are reviewed and approved by the respective individuals.

Try it for free

Unlock all generate.TAX features for 30 days to help you with the generation of VAT returns

- Connects to Xero

- Safe and secure

- Cancel any time