Designed

for Accountants

User Access Control

The system allows multiple users to login, with the ability to assign roles such as preparer, reviewer and approver for access control. This enables efficient delegation of tasks and ensures a streamlined workflow with distinct user permissions.

EMEA Tax Software

generate.TAX helps you file VAT returns and other VAT declarations and statements in multiple countries across EMEA and beyond. The countries that are currently supported by generate.TAX include Malta, Cyprus, Ireland, UAE, Isle of Man, Sweden and Netherlands.

Currency Conversion

The system has in-built foreign currency conversion capabilities based on ECB rates to allow users with the ability to translate transactional data into a different currency and thus allowing for the preparation of VAT returns in a currency other than the accounting presentation currency.

How generate.TAX can help you

VAT Compliance Reminder

Timely alerts and reminders on your VAT reporting deadlines and payment due dates, helping you avoid late submission penalties.

VAT Return Preparation

Helps you to streamline the process of preparing VAT returns and other declarations and reports by organising transactional data and facilitating electronic filing with tax authorities.

VAT Record-Keeping

Ability to store VAT returns and associated documents in accordance with VAT record-keeping regulations, guaranteeing effortless retrieval when needed. This capability ensures compliance with requirements while facilitating convenient access to essential documents for auditing and reporting purposes.

VAT Audit

Ability to uphold a thorough audit trail of VAT-related transactions and adjustments, providing transparency and accountability in VAT reporting and compliance tasks. With generate.TAX, essential information can be readily extracted, enabling smooth reconciliation of VAT data and efficient responses to inquiries. This helps to streamline any audit process and thus make the data gathering process more efficient and timely.

VAT Return Generator

Quickly generate your VAT return and other declarations and reports by seamlessly accessing and utilising data stored in your accounting system. This streamlined process eliminates the manual data entry for VAT reporting and ensures accuracy in your VAT returns.

Recapitulative Statement

Compile a register of intra-community suppliers for submission with VAT authorities. The system ensures accuracy of the information extracted from the accounting package, including validating each customer’s VAT number against the VAT Information Exchange System (VIES).

Solutions

Recapitulative Statement

Create a validated list of intra-community suppliers to be submitted to authorities.

FAQs

What is generate.TAX?

- Automatic VAT return preparation: No more manual calculations, the app does it for you.

- Workflow management: Keep your VAT tasks organised and on track.

- VAT filing deadline reminders: Never miss a deadline again with timely alerts.

- VAT number checks: Verify VAT numbers quickly and easily.

- Reconciliation and issue fixing: Spot and resolve discrepancies without a sweat.

- Audit trails and note-keeping: Maintain clear records for easy reference.

- Direct filing: If the tax authority has an API, you can file right from the app.

generate.TAX works by pulling data from your accounting software, identifying the VAT-related info, and presenting it just like your local VAT return form. It’s VAT compliance made simple!

Is generate.TAX compliant with local VAT regulations?

Can generate.TAX handle VAT returns for multiple countries?

What types of returns can be submitted using generate.TAX?

What are the key features of generate.TAX?

- Verification of Customer and Supplier VAT numbers through the VIES checker;

- 2 factor authentication for security purposes;

- Generation of VAT reports with the click of a button;

- Analysing transactions through the app with a click-through functionality that would take the user directly to the accounting software should any adjustment need to be made;

- Detailed workflow and audit trail showing the preparer, reviewer and client approval;

- Capturing any exceptions noted in the VAT returns, including any invoice relating to prior period which was posted after VAT return was submitted.

How easy is it to integrate generate.TAX with existing systems?

How can generate.TAX help in managing workflow for VAT compliance tasks?

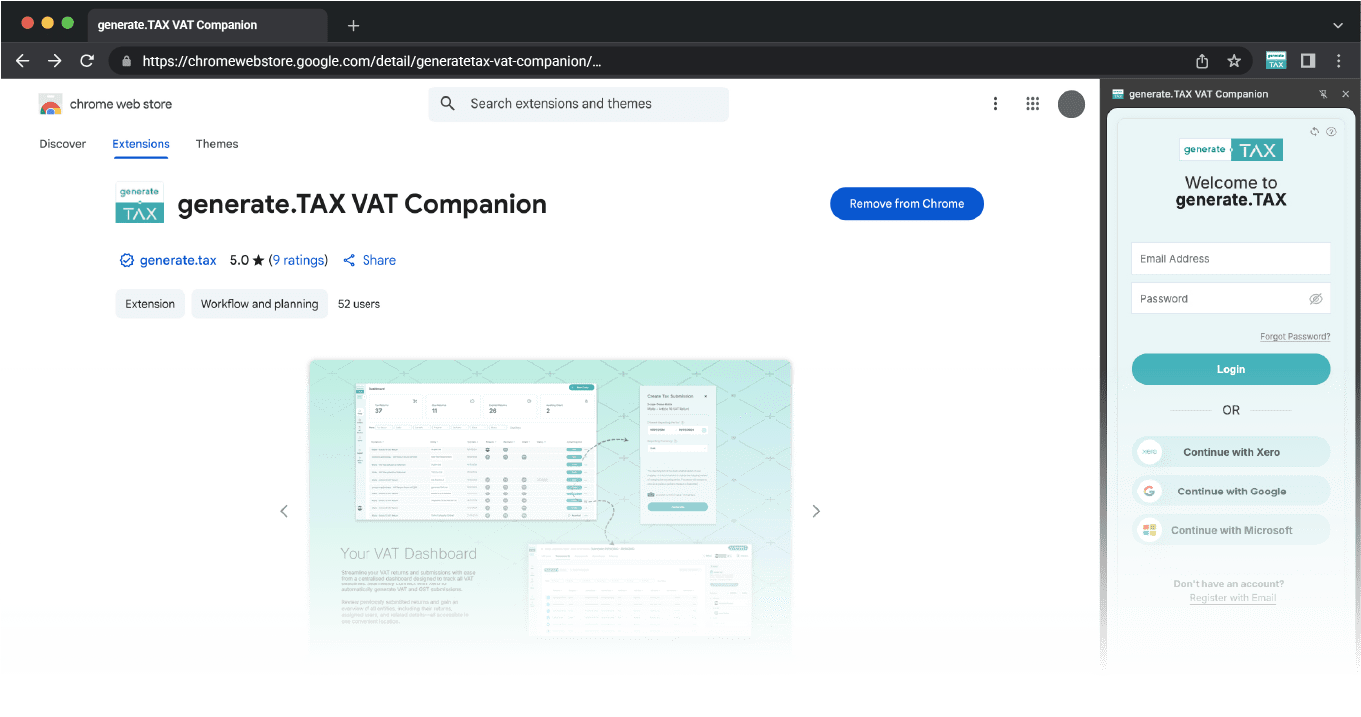

Try it for free

Unlock all generate.TAX features for 30 days to help you with the generation of VAT returns

- Connects to Xero

- Safe and secure

- Cancel any time